Acorns Review – Is it Worth it?

Recently Acorns has been growing in popularity, and with the rise of easy investing apps, it’s clear to see why. Not only is there a massive movement, but Acorns may be the easiest way to get started. But is it worth it?

Acorns Pros

Round ups are awesome!

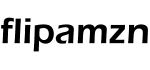

Seriously, they are one of the few in this space that does this and it is a great idea. Round up your purchases and invest the change. It’s brilliant, and the main reason Acorns is shooting up in popularity. How it works is that whenever you spend money, Acorns keeps a ‘tab’ of the rounded up amount. Once you hit $5, they pull that $5 from your account and invest it. Seriously, its genius.

It’s a great starting point.

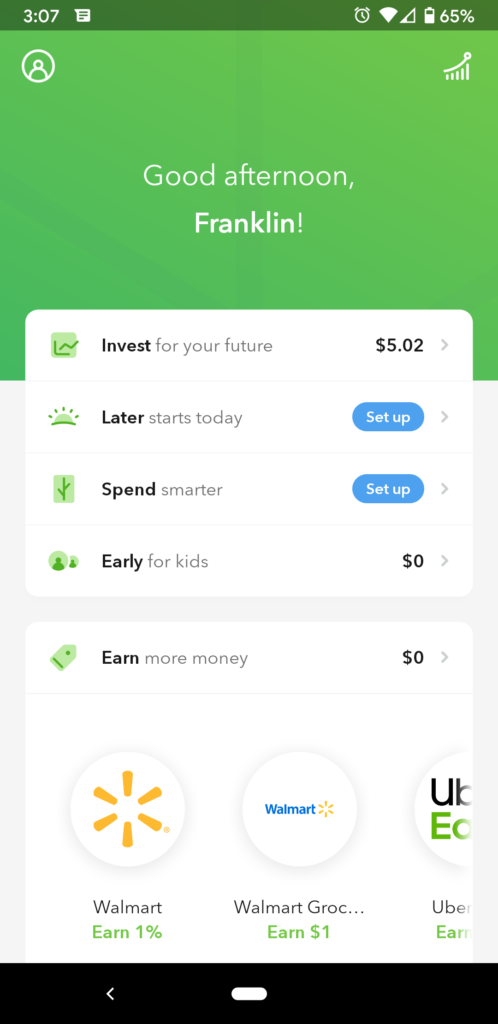

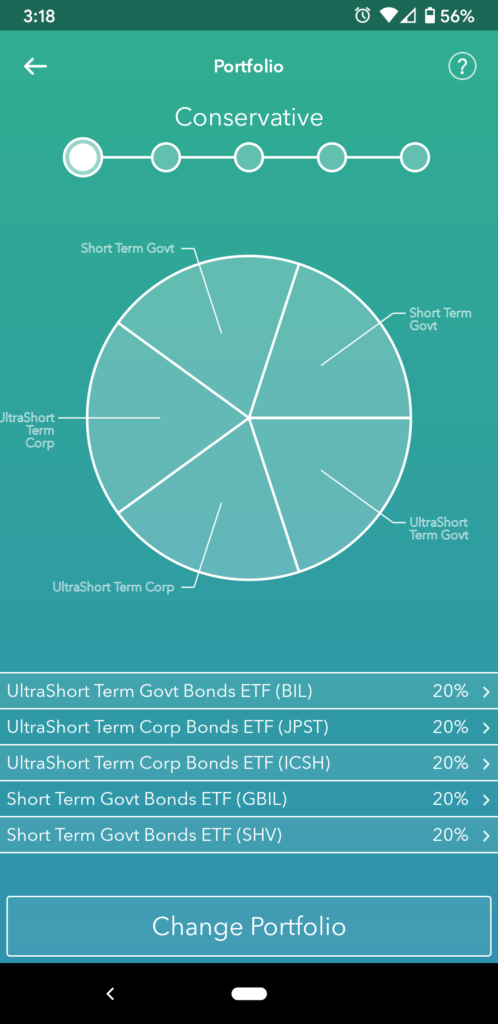

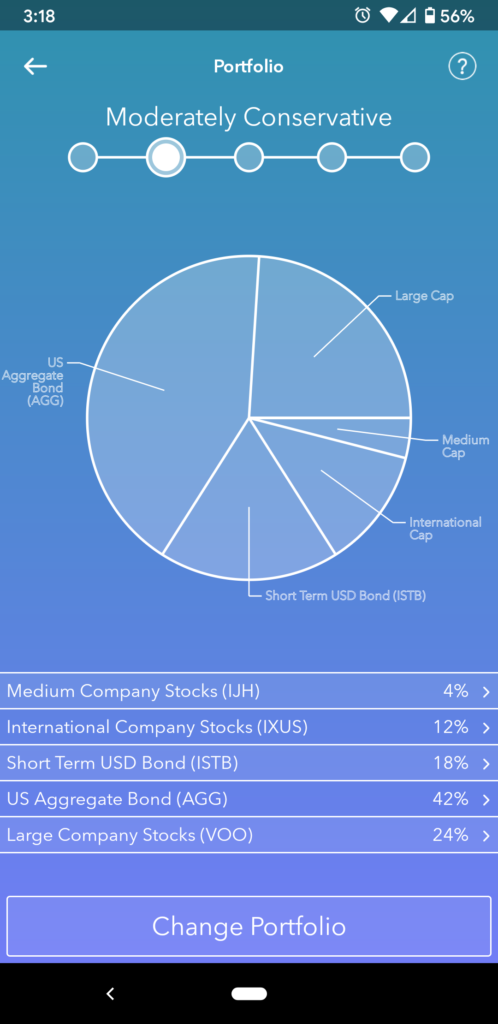

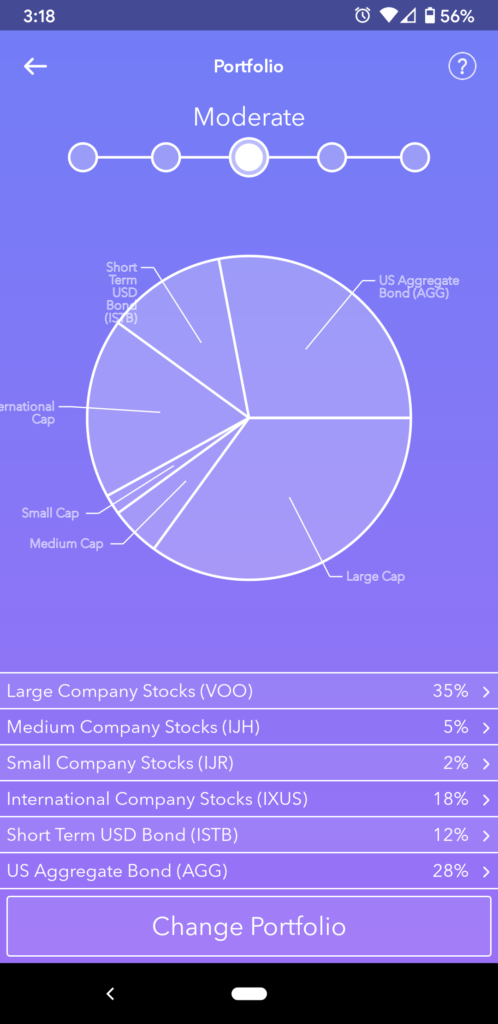

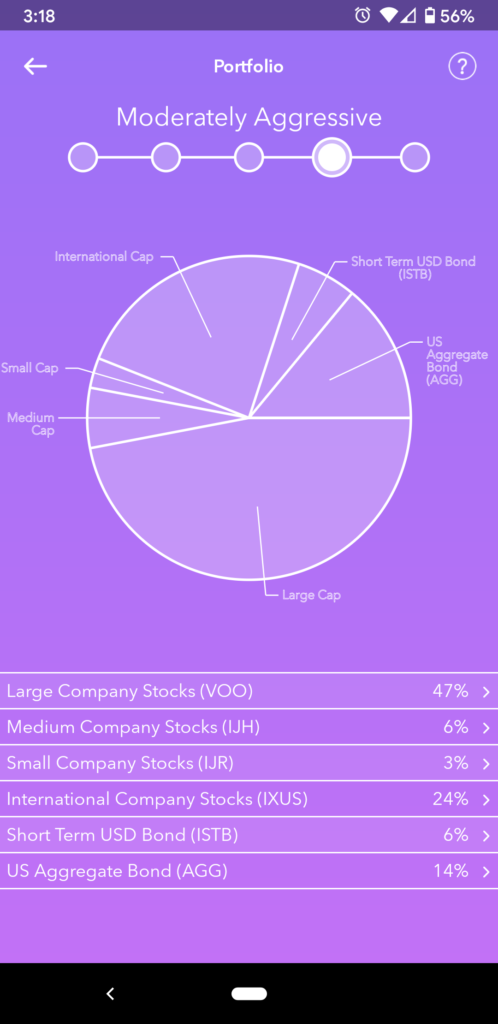

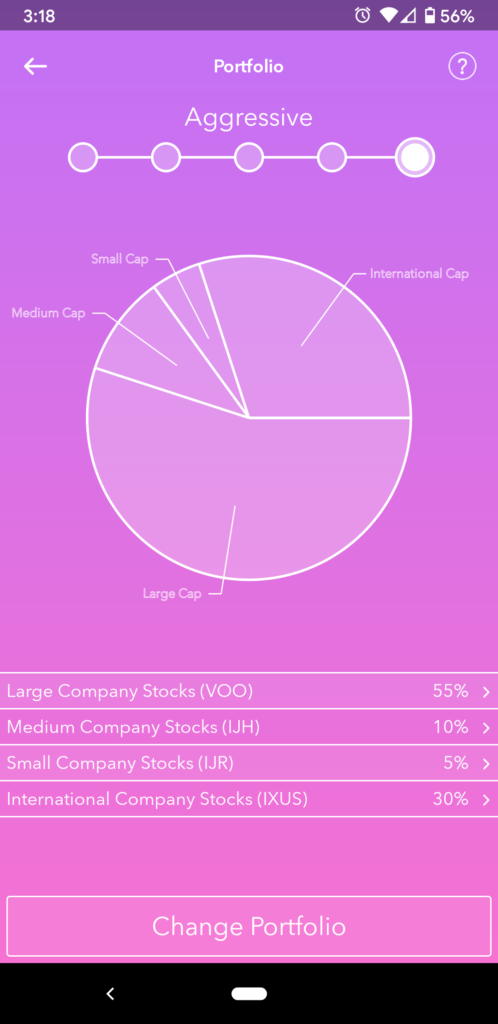

Because it’s so easy, it really is a great way to start investing. The two biggest oppositions I hear when I talk to someone who is not invested is what if I lose all my money and, what would I even buy? Well, historically even when the market crashes it eventually regains itself. As long as you are not trying to day trade penny stocks, or fully vested into a single company, you should perfectly fine. And when it comes to the question of what to buy, I ask “what company do you like and think will do good in the future?” Or, I advise them to invest in SPY, which is an ETF that mimics the S&P 500 (which is a pool of 500 mid and large cap stocks itself). Anyways, the point is that with Acorns you don’t have to think about any of that. You pick your risk level, and it does it for you automatically. So for someone who is new and / or unsure, automatically investing spare change literally might be the best and easiest way to get started.

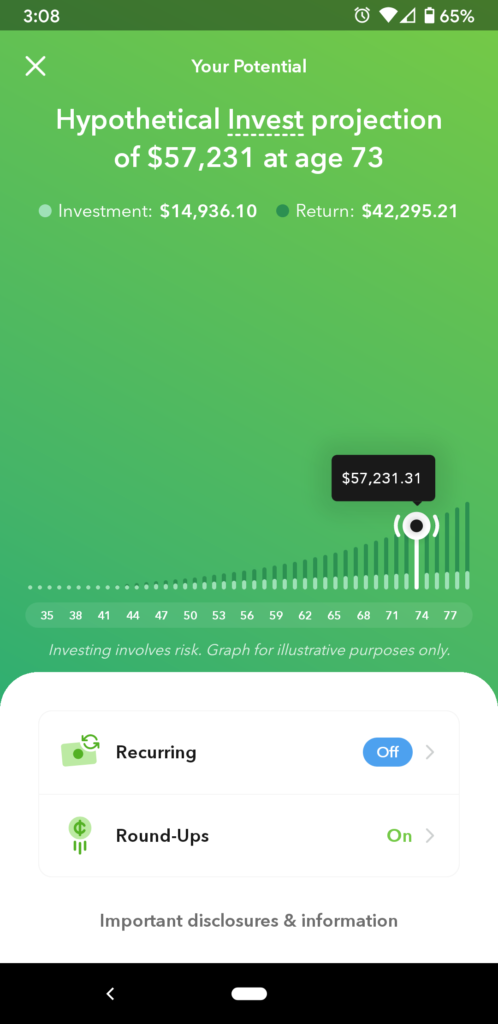

The knowledge center is nice.

Going back to the idea that this is a great app for beginners, the knowledge center has… well a lot of knowledge. There are tons of topics like Investing, Retiring, Saving, and Borrowing, all with multiple articles that are explained in a way that is easy to digest. It is a really nice addition given what Acorns is setting out to do.

Acorns Cons

Fees are killer

Right out of the gate, I am going to say price. Price is a major drawback of Acorns even though it seems cheap. Plans start at $1 / month, $3 / month if you want a card (seriously, who needs yet another card?), and $5 / month if you want a family plan with custodial accounts. It may not seem like much, but if you are paying $5 / month and only have $50 in your account then you are paying 10% per month in fees. That is insane! Even if you’re only paying $1 / month and have $100 in your account, that is still 1% fees per month, and that is still a lot compared to Vanguards ETF fee of 0.03% per year. If you have $40,000 invested in the app then the fees are comparable, but if you’re going to invest that much you’ll probably want to use another service anyways.

You cant pick your investments

Acorns automatically invests in different funds based on your risk model. Its both a pro and a con. That makes it super easy to invest, but you cant really pick stocks, specific funds, or ETFs like you can with, well… pretty much anything else. Personally, I feel this is more bad than good. Even if it does take the choice of pain out of the equation.

Custodial Accounts, kind of suck

The other major feature that convinced me to sign up for Acorns was the custodial accounts. I was really excited to see how they work and to get the kids more into investing. What I was hoping was that I could use my ’round ups’ and automatically split them between the kids accounts. You cant… In fact, you cant even move money from your account into theirs. It has to be a deposit, either one-time or recurring. So basically, you cant even use the best feature of the app for your kids.

‘Earn more money’ affiliates are kind of a rip off

You have the option to ‘earn more’ by completing a checkout session after clicking on one of the sponsors in the app. Places like Walmart, Walmart Groceries, Nike, and GrubHub all can get you a little extra in your account. Which is cool, sort of. The reason it is in the cons list is because they only offer a fraction of what other cash back portals like Rakuten offer. The $0.25 Acorns gives you for using GrubHub is 2% on Rakuten. The 5% you get from Nike, could be 6%. So its a nice idea, and it makes sense. But you can certainly (and should) do better.

Acorns Screenshots

Summary

If you’re new to investing, or even a little worried about getting started, then Acorns will do you well. Unfortunately, it does not have much to offer someone who has been investing for awhile, other than the cool round up feature. I signed up for the $5/mo. family plan, but it immediately fell short of my expectations. So I will keep Acorns for now, but I am going to be moving to the $1/mo. plan, and honestly I am not sure how long that will stick around. But you get free money just for signing up, so that’s cool.